Digital asset management has always been a fragmented mess. Users juggle multiple platforms just to handle basic financial needs—investing, trading, and spending each require different apps, different logins, different headaches. Need DeFi yields? Fire up a protocol-connected wallet. Want to trade spots or futures? Log into a centralized exchange, create yet another account, transfer funds around. Planning to spend crypto on everyday purchases? Better apply for that third-party crypto card and hope it works.

The result? Account overload, password chaos, security nightmares—your assets scattered across platforms, workflows that make no sense, and an experience that feels broken by design.

This fragmentation creates more than just operational friction. It kills portfolio visibility, slows decision-making, and makes compliance a bureaucratic maze. Even the most promising crypto payment cards tend to crash and burn, victims of unsustainable economics or regulatory crackdowns. The real problem runs deeper: today’s financial infrastructure simply wasn’t built for unified digital asset management, leaving users frustrated and underserved.

exSat Bank: Reimagining On-Chain Banking

Traditional finance suffers from information silos, capital inefficiency, scattered services, and poor value realization. The crypto world inherited these problems and made them worse. exSat Bank tackles this head-on with a fundamentally different approach: unified on-chain banking that breaks down the walls between asset management, payments, trading, and risk control, creating one cohesive operating system that actually works.

This isn’t just another fintech app. exSat Bank is building a comprehensive financial hub for individuals and institutions alike—think of it as financial infrastructure powered by an on-chain operating system with plug-and-play modules. Store assets, generate yields, make payments, move money between platforms—everything happens through one account with complete visibility and control.

One Account, Everything Connected

Our unified identity and account architecture replaces the traditional maze of separate accounts. Think bank account, brokerage, exchange, and wealth manager rolled into one, seamlessly bridging on-chain and traditional finance.

Single authentication unlocks API connections to major exchanges like Binance and OKX, enabling real-time asset synchronization and cross-platform fund management.

Here’s what that means: no more endless KYC processes, no more password juggling, no more guessing where your money is. Every transaction, every position, every yield streams into exSat Bank in real-time, giving you a complete financial picture. Monthly DeFi earnings? Cross-chain arbitrage performance? It’s all there, clear as day.

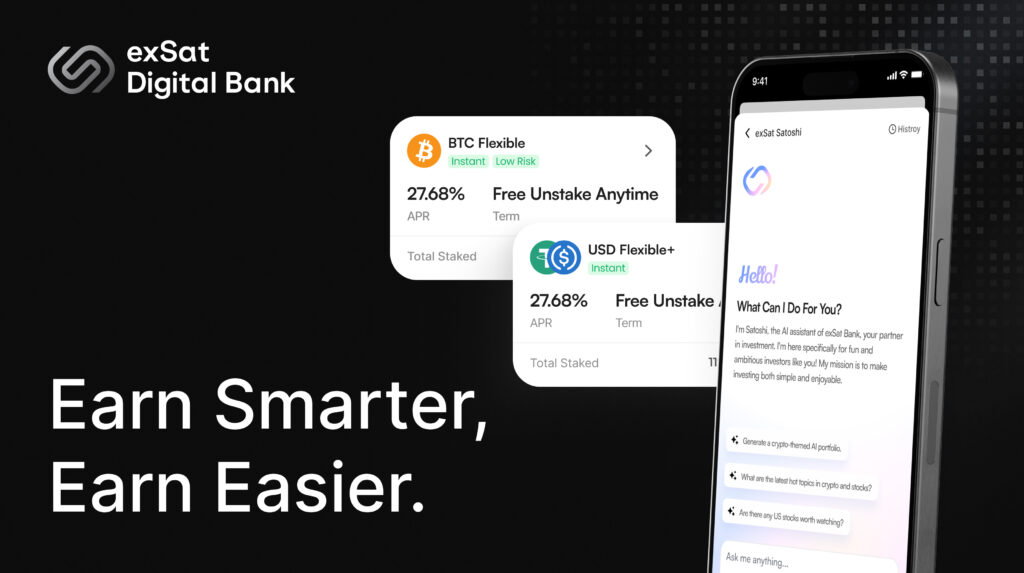

AI-Powered Investment Intelligence

Our AI engine analyzes on-chain data and market conditions to deliver personalized investment recommendations, risk alerts, and strategy optimization in real-time. Whether you’re a crypto novice or seasoned trader, you get institutional-quality insights tailored to your goals and risk tolerance. It’s like having a top-tier investment advisor working around the clock, just for you.

Spend Your Crypto Anywhere

Asset appreciation means nothing if you can’t actually use your money. exSat Bank bridges on-chain wealth and real-world spending through crypto cards, QR payments, and other payment rails. Your portfolio isn’t just an investment—it’s spending power you can deploy instantly, completing the circle from allocation to transaction.

Flexible Yield Generation

Built on the exSat network with strategic partnerships, our platform aggregates DeFi yields, staking rewards, and traditional income streams into customizable, multi-layered strategies. Configure your approach, let our system handle the allocation and compounding, maximizing returns while maintaining the liquidity and security you need.

Built for Everyone

Crypto veterans can connect wallets directly to smart contracts for full control and transparency. Traditional finance users get intuitive app interfaces that hide blockchain complexity behind familiar banking workflows. Same powerful infrastructure, tailored for different comfort levels.

V1 Launch: Flexible Yield Available Now

We’re starting with what users need most: secure, profitable savings that actually work. Our flexible savings product establishes the foundation for the complete financial ecosystem coming next.

Deployed on EVM-compatible chains, the system currently supports major stablecoins including USDT and USDC. Deposit funds into our smart contract-managed pools, and our automated systems deploy capital across quantitative trading strategies, with interest calculated per block and distributed daily.

Four Core Features of Flexible Yield

- Transparent On-Chain Settlement: All activity—deposits, withdrawals, earnings—is governed by smart contracts. Data oracles align returns with actual exchange performance, removing manual errors and ensuring full auditability.

- High Liquidity, No Lockups: Users can enter and exit positions freely, making this ideal for those who value agility in volatile markets.

- Regulated Custody and Asset Security: Assets are safeguarded by licensed institutions such as Standard Chartered Bank, while on-chain mirrors ensure visibility and trust. Dedicated quant teams execute institutional-grade strategies via segregated exchange accounts.

- Real-Time Strategy Monitoring: Trading performance and yield distribution are pushed on-chain at regular intervals, allowing users to track results transparently and make informed decisions.

With this architecture, exSat Bank delivers the trifecta of security, transparency, and usability, giving both novice and advanced users a smarter path to on-chain returns.

The Future of Finance is Here

exSat Bank isn’t just launching a product—we’re pioneering the next evolution of financial services. Real Web3 banking transcends the CeFi-DeFi divide, creating a unified hub that connects exchanges, aggregates portfolio data, streamlines operations, and maintains regulatory compliance without compromise.

Our roadmap centers on the integrated banking model: unified accounts + AI advisory + universal payments + intelligent asset management. We’re expanding what’s possible in Web3 finance while keeping the experience simple enough that users don’t need to understand blockchain mechanics to benefit from them.

Ready to experience the future of digital finance? Visit exSat Bank and start your on-chain wealth management journey today.